Дата обновления: 19.02.2026, 16:28

Corporate governance

Corporate governance

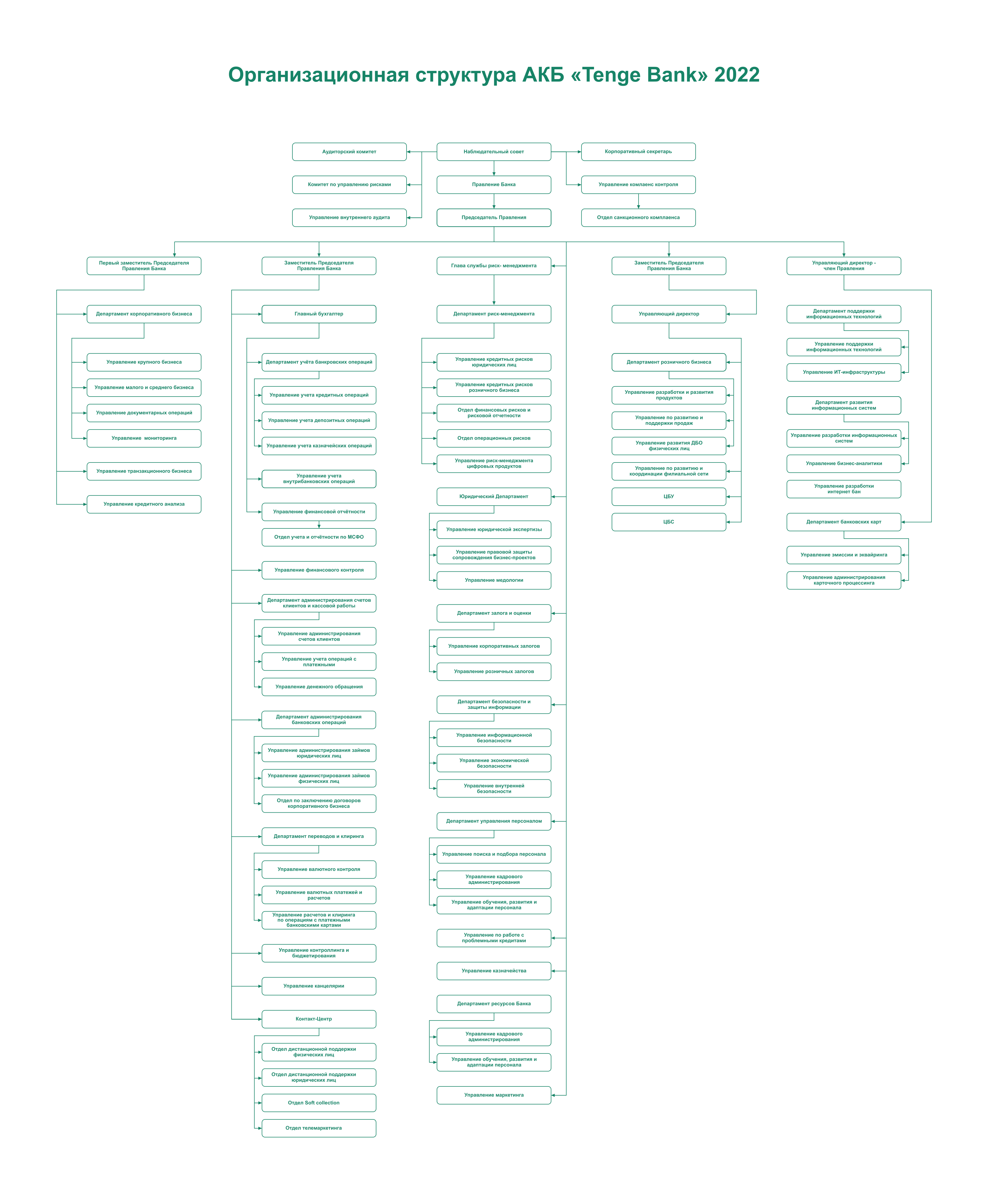

High-quality corporate governance is a prerequisite for Tenge Bank's successful operation in a free and competitive market. The Bank needs an effective corporate governance system that establishes relations between the Bank's Supervisory Board, Board and shareholders. Such a system contributes to the growth of the Bank's value and ensures investors that their money is used effectively. We attach special importance to the development of corporate governance and strive to build a corporate governance system that meets the high international standards that a modern world-class financial institution must meet.

Corporate governance policy

Supervisory Board of the Bank

The Supervisory Board of the Bank is a collegial management body of the Bank, which carries out general management of its activities, with the exception of resolving issues referred to the exclusive competence of the general meeting of shareholders by the current laws of the Republic of Uzbekistan and the Charter of the Bank. The main objectives of the Bank's Supervisory Board are to monitor the effective management of the Bank's activities in order to ensure the sustainable long-term development of the Bank, the growth of its value, and the protection of the rights and legitimate interests of shareholders.

The Board of the Bank

The Board of the Bank, being the executive management body of the Bank, carries out operational management of the Bank in accordance with the strategy and management system approved by the Sole Shareholder and the Supervisory Board of the Bank, and is fully responsible for the activities of the Bank.

The Board is accountable to the Supervisory Board and the Sole Shareholder of the Bank.

The Board is accountable to the Supervisory Board and the Sole Shareholder of the Bank.

Audit Committee

The Audit Committee is a collegial body attached to the Supervisory Board.

The purpose of the Committee's activities is to assist the Supervisory Board of the Bank in carrying out the functions of ensuring:

1) completeness and reliability of the Bank's financial statements, including consolidated ones;

2) appropriate qualifications and independence of external and internal auditors;

3) interaction with the external audit;

4) effective internal audit activities;

5) consideration of other issues within the competence of the Committee.

Composition:

1) Independent member of the Supervisory Board of the Bank - Abduraxmanov Doniyor Marselevich;

2) Member of the Supervisory Board of the Bank - Sartayev Dauren Jankiseyevich;

3) Independent member of the Supervisory Board of the Bank - Utegulov Maulen Amangeldiyevich.

The purpose of the Committee's activities is to assist the Supervisory Board of the Bank in carrying out the functions of ensuring:

1) completeness and reliability of the Bank's financial statements, including consolidated ones;

2) appropriate qualifications and independence of external and internal auditors;

3) interaction with the external audit;

4) effective internal audit activities;

5) consideration of other issues within the competence of the Committee.

Composition:

1) Independent member of the Supervisory Board of the Bank - Abduraxmanov Doniyor Marselevich;

2) Member of the Supervisory Board of the Bank - Sartayev Dauren Jankiseyevich;

3) Independent member of the Supervisory Board of the Bank - Utegulov Maulen Amangeldiyevich.

Risk Management Committee

The Risk Management Committee is a collegial body attached to the Supervisory Board.

The task of the Committee is to assist the Supervisory Board in forming an effective risk management system and internal control system of the Bank, ensuring timely identification, measurement, monitoring and control of operational, credit, market risks, liquidity risk, information technology and information security risks, compliance risks.

Composition:

1) Independent member of the Supervisory Board of the Bank - Majenova Baxit Mursalimovna;

2) Chairman of the Supervisory Board - Koshenov Murat Uzakbayevich;

3) Independent member of the Supervisory Board of the Bank - Utegulov Maulen Amangeldiyevich.

The task of the Committee is to assist the Supervisory Board in forming an effective risk management system and internal control system of the Bank, ensuring timely identification, measurement, monitoring and control of operational, credit, market risks, liquidity risk, information technology and information security risks, compliance risks.

Composition:

1) Independent member of the Supervisory Board of the Bank - Majenova Baxit Mursalimovna;

2) Chairman of the Supervisory Board - Koshenov Murat Uzakbayevich;

3) Independent member of the Supervisory Board of the Bank - Utegulov Maulen Amangeldiyevich.

Committees under the Board of the Bank

1. The Credit Committee for Lending for business purposes.

Implementation of the Bank's internal Credit policy regarding the provision and maintenance of financial instruments for business purposes within the authority of the Regulations on the Committee.

2. Retail Credit Committee.

Ensuring the effective use of credit resources, managing credit risks and the Bank's loan portfolio, implementing the Bank's Credit Policy in order to ensure maximum profitability of retail credit operations within the acceptable risk level and limits of the RCC for reviewing projects established by the Bank's Management Board, as well as optimizing the quality of the retail loan portfolio.

3. The Credit Committee of the branch network.

The main task of the Committee is to implement the internal credit policy of the Bank in terms of providing financial instruments through branches, points of sale of the Bank within the powers established by the Regulations on the Committee.

4. Asset and Liability Management Committee.

Assistance to the Board of the Bank in managing the structure of the Bank's balance sheet in order to maximize profitability from banking activities as well as establish the Bank's medium and long term policy.

5. Committee for the Improvement of Information Technology and Operational Processes.

The purpose of the Committee is the effective management and implementation of Projects aimed at achieving the Bank's strategic goals.

The main tasks are:

1) making decisions on determining the Bank's priority IT tasks and Projects within the Bank's existing IT resources in order to optimize business processes.

2) making decisions on issues of financial, economic and current expediency, updating the implementation of the Bank's IT Projects provided for within the approved budget of the Bank.

6. Tariff Committee.

The purpose of the Committee is to ensure an acceptable level of profitability from the provision of banking services and to optimize the Bank's tariff policy.

7. Operational Risk Management Committee

The task of the Committee is to assist the Board in the formation of an effective risk management system of the Bank, ensuring timely identification, measurement, monitoring and control of operational risks, information technology risks and information security.

8. Committee on Problem Loans

The main task is to accelerate and optimize the process of repayment of non-performing loans, decisions are made in order to improve the quality of the Bank's assets.

Implementation of the Bank's internal Credit policy regarding the provision and maintenance of financial instruments for business purposes within the authority of the Regulations on the Committee.

2. Retail Credit Committee.

Ensuring the effective use of credit resources, managing credit risks and the Bank's loan portfolio, implementing the Bank's Credit Policy in order to ensure maximum profitability of retail credit operations within the acceptable risk level and limits of the RCC for reviewing projects established by the Bank's Management Board, as well as optimizing the quality of the retail loan portfolio.

3. The Credit Committee of the branch network.

The main task of the Committee is to implement the internal credit policy of the Bank in terms of providing financial instruments through branches, points of sale of the Bank within the powers established by the Regulations on the Committee.

4. Asset and Liability Management Committee.

Assistance to the Board of the Bank in managing the structure of the Bank's balance sheet in order to maximize profitability from banking activities as well as establish the Bank's medium and long term policy.

5. Committee for the Improvement of Information Technology and Operational Processes.

The purpose of the Committee is the effective management and implementation of Projects aimed at achieving the Bank's strategic goals.

The main tasks are:

1) making decisions on determining the Bank's priority IT tasks and Projects within the Bank's existing IT resources in order to optimize business processes.

2) making decisions on issues of financial, economic and current expediency, updating the implementation of the Bank's IT Projects provided for within the approved budget of the Bank.

6. Tariff Committee.

The purpose of the Committee is to ensure an acceptable level of profitability from the provision of banking services and to optimize the Bank's tariff policy.

7. Operational Risk Management Committee

The task of the Committee is to assist the Board in the formation of an effective risk management system of the Bank, ensuring timely identification, measurement, monitoring and control of operational risks, information technology risks and information security.

8. Committee on Problem Loans

The main task is to accelerate and optimize the process of repayment of non-performing loans, decisions are made in order to improve the quality of the Bank's assets.